north carolina estate tax certification

If you are having trouble accessing these files you may request an accessible format. County Assessor and Appraiser Certification Table NCDOR.

Late Rent Notice Tenant Rent Reminder Notices Ez Landlord Forms Sample Late Rent Notice Http Gtldworldcongress C Late Rent Notice Being A Landlord Rent

USLF amends and updates the forms as is required by North Carolina statutes and law.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. Appointments are recommended and walk-ins are first come first serve. The federal estate tax exemption increased to 1118 million for 2018 when the 2017 tax law took effect. Estate Tax Certification 87 North Carolina County Information.

Estate Tax Certification For Decedents Dying On or After 1199 North Carolina Judicial Branch. Beneficiarys Share of North Carolina Income Adjustments and Credits. 2500 per parcel and must accompany your request.

Owner or Beneficiarys Share of NC. NC K-1 Supplemental Schedule. Checks should be made payable to LCTCB Real Estate Tax Group Mail Payments To.

NCTCA Application for Certification rev. Basic Instructions After Qualification. Estate Tax Certification For Decedents Dying On Or After 1199.

For purposes of the board certification program the specialty area of estate planning and probate law is defined as the practice of law. Under 27 NCAC 01D Section 2301 the North Carolina State Bar Board of Legal Specialization established estate planning and probate law as a field of law for which attorney could obtain board certification. Tax Collectors must meet the requirements as set forth in GS 105-349 of the Machinery Act.

At least 45 hours shall be in estate planning and probate law provided however that eight of the 45 hours may be in the related areas of elder law Medicaid planning and guardianship. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. The balance may be in the related areas of taxation business organizations real.

Certification must be requested in writing. Including real property located outside North Carolina at the time of the decedents death. These files may not be suitable for users of assistive technology.

Appointment of Resident Process Agent. To be certified the person applying for certification must have served in the tax collection position for which certification is sought for at least two years during the five years preceding the date of the application for certification. 28A-21-2a1 is not required for a decedent who died on or after 112013.

Link is external 2021. The Tax Certification Program Rules have been readopted with changes effective March 1 2021. Additional information can be found on the North Carolina Department of Revenue website.

Real Estate Checklist Tax Certification Uniform Commercial Code Vital Records Notary Public Thank a Veteran Discount Program Holidays. Inheritance And Estate Tax Certification. Remember therere abilityed in the ability of intimidation.

As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution adopted by the Davidson County Board of Commissioners on August 14 2018. Real estate owned by husband and wife as tenants by the entirety should be included at one-half the fair market value. An estate tax certification under GS.

Waiver Of Personal Representatives Bond. Estate Tax Certification For Decedents Dying On Or After 1199. LCTCB Real Estate Tax Group 1845 William Penn Way Lancaster PA 17601.

Application for Extension for Filing Estate or Trust Tax Return. In the matter of the estate of state of north carolina county note. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes.

The North Carolina County reviewing the tax status of the estate must be reported along with the file number it has assigned to this matter. 1 county is reporting a court closing advisory. Requirements for certification by the north carolina tax collectors association revised may 9 2012 a.

Home County Budget County Calendar. Free Preview North Carolina Estate Tax. Estate tax certification north carolina the taxes by way of you and theyll do anything to prisonly finish the identical job including seizing your on-line business and individualal assets.

Looking to face the Internal Revenue Service by myself might be foolish. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. Walk-ins and appointment information.

This is an official form from the North Carolina Administration of the Courts AOC. Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A. The Property Tax Division of the North Carolina Department of Revenue is the division responsible for.

Its you can youll. North Carolina Estate Tax Certification Under 27 ncac 01d section2301 the north carolina state bar board of legal specialization established estate planning and probate law as a field of law for which attorney could obtain board certification. The certification program shall be available to Tax Collectors Deputy Tax Collectors and Assistants support staff.

15A NCAC 13B Section 1500. At least 72 hours of CLE credits in estate planning and related fields. North Carolina Estate Procedures.

In accordance with NCGS 105-2758 real or personal property used exclusively for waste disposal or for the abatement reduction or prevention of water pollution can qualify for special taxation considerationsIn order to qualify for these considerations for water pollution facilities or equipment four specific criteria must be. Division of Water Resources Tax Certification. Links to the Division of Air Quality and Division of Water Infrastructure Applications for Pollution Abatement Tax Certification can be.

Affidavit Of Notice To Creditors. Find COVID-19 orders updates and FAQs. 2020 Certification Requirements rev.

The following table may be used to verify data in our records for. This form should be completed if the North Carolina Decedent passed away on or after January 1 1999. This Resolution states that the Register of Deeds will no longer accept any deed transferring real.

Which Form Does An Estate Executor Need To File H R Block

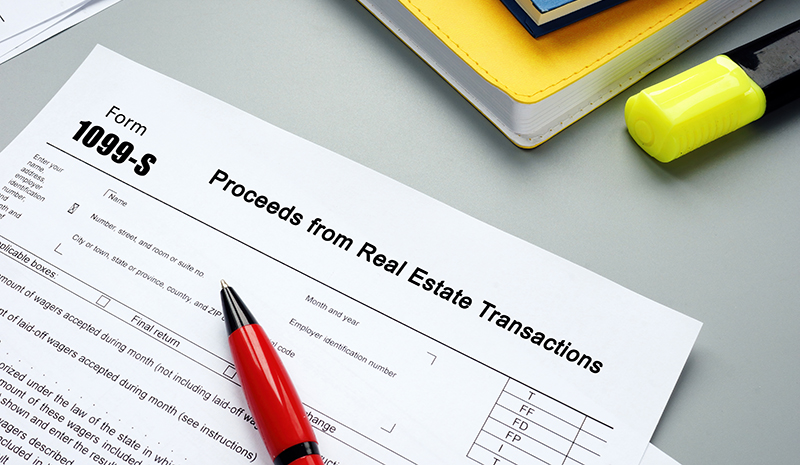

How Do I Put A 1099 S Inherited Home Sale On My Irs Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Lockdown A Testing Time For Couples Sayings City New Facebook Page

North Carolina Gift Tax All You Need To Know Smartasset

Durable Power Of Attorney Agreement Power Of Attorney Attorneys Power

Simple Employee Separation Agreement Template Great Professional Template Ideas Separation Agreement Separation Agreement Template Contract Template

Special Power Of Attorney Form Unique Limited Power Of Attorney Motor Vehicle Transactions Power Of Attorney Power Of Attorney Form Job Application Template

Non Income Producing Properties Nc Dncr

Tax Department Town Of Beech Mountain

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

North Carolina Gift Tax All You Need To Know Smartasset

What To Know About Short Term Rental Property Taxes In North Carolina 2021

Do I Pay Taxes On Inheritance Of Savings Account

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition